Study with Quizlet and memorize flashcards containing terms like Cash may not include:, Compensating balances represent:, On November 10 of the current year, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. Flores uses the gross method of accounting for sales discounts.What is the correct entry for Flores on November 10? and more.

FoodBlogs: The Magazine by gratefulink – Issuu

On November 10 of the current year, Flores Mills provides services to a customer for $8,000 with credit terms 2/10, n/30. The customer made the correct payment on December 5. How would Flores record the collection of cash on December 5? … $5,000 in property taxes include $4,000 in back taxes paid by Real Angus on behalf of the seller and

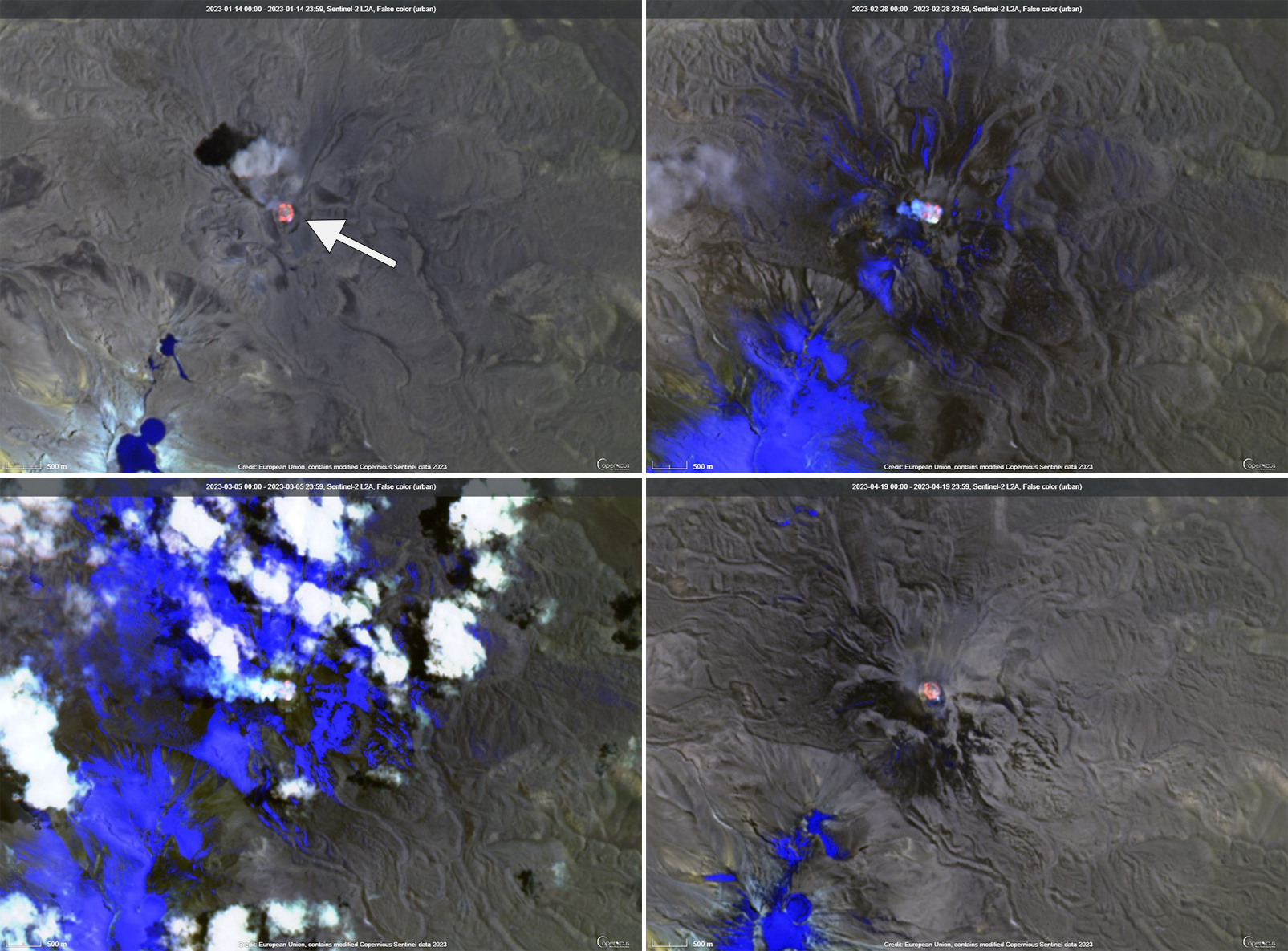

Source Image: volcano.si.edu

Download Image

May 25, 2023On November 10, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. The way Flores would record the sale on November 10th is by debiting Accounts Receivable for $8,000 and crediting Sales Revenue for $8,000.. The customer has 30 days to pay for the carpet but may deduct a 2% discount from the amount owed if paid within 10 days (2/10).

Source Image: en.wikipedia.org

Download Image

PPT – Southeast Asia PowerPoint Presentation, free download – ID:1550957 Jul 4, 2023sarthakcontexto123 report flag outlined The correct entry for Flores Mills on November 17, assuming the correct payment was received on that date, would be as follows: 1. First, let’s understand the credit terms mentioned in the question: – “410/” means that the customer can avail a 4% discount if they pay within 10 days.

Source Image: mdpi.com

Download Image

On November 10 Of The Current Year Flores

Jul 4, 2023sarthakcontexto123 report flag outlined The correct entry for Flores Mills on November 17, assuming the correct payment was received on that date, would be as follows: 1. First, let’s understand the credit terms mentioned in the question: – “410/” means that the customer can avail a 4% discount if they pay within 10 days. A) $9,450. B) $12,450. C) $7,450. D) $19,650., On November 10 of the current year, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. Flores uses the gross method of accounting for sales discounts. What is the correct entry for Flores on November 17, assuming the correct payment was received on that date?, Calistoga

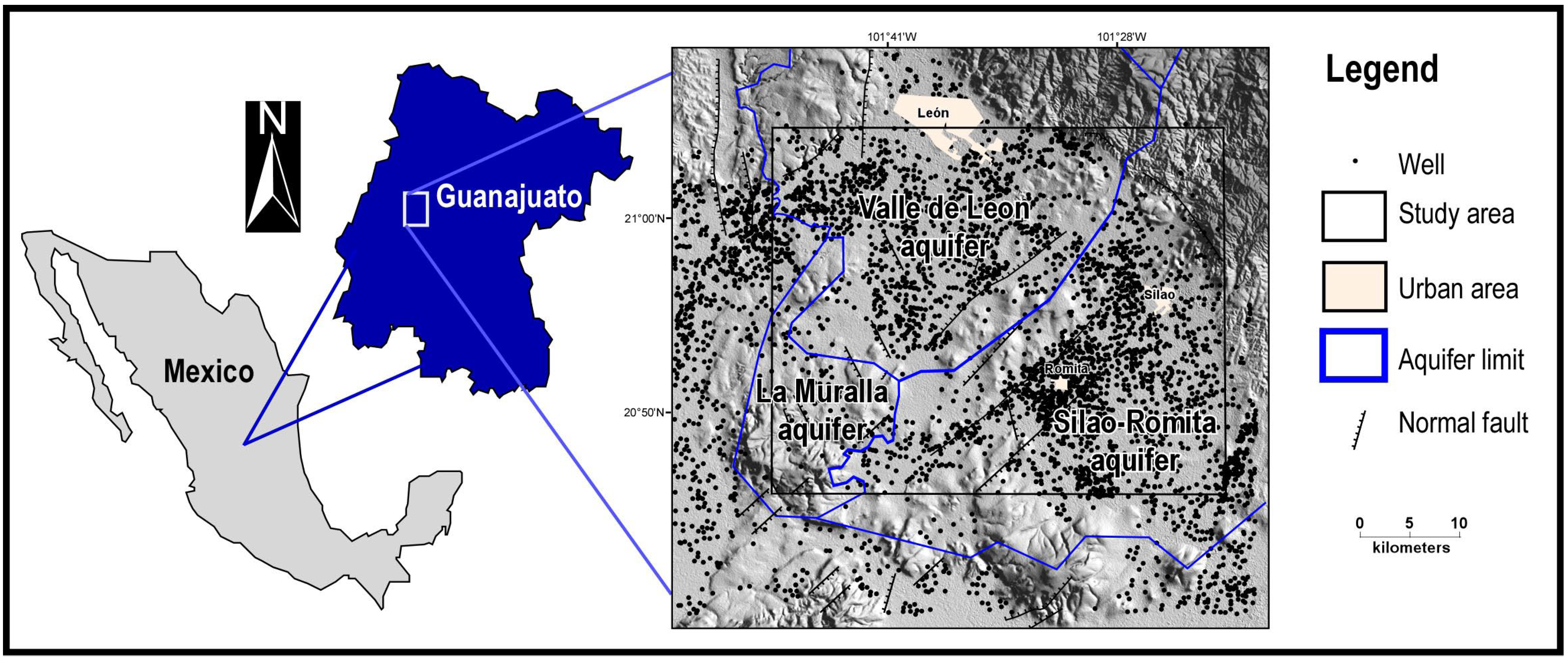

Water | Free Full-Text | Hydrogeochemical Characterization of Groundwater at the Boundaries of Three Aquifers in Central México

See Answer Question: On November 10 of the current year, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. Flores uses the gross method of accounting for sales discounts. What is the correct entry for Flores on November 10? A) Accounts receivable 7,840 Sales 7,840 B) Accounts receivable 8,000 Mayra Flores’ social media controversy highlights discord among South Texas Republicans | TPR

Source Image: tpr.org

Download Image

Full article: Additive manufacturing and characterization of mathematically designed bone scaffolds based on triply periodic minimal surface lattices See Answer Question: On November 10 of the current year, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. Flores uses the gross method of accounting for sales discounts. What is the correct entry for Flores on November 10? A) Accounts receivable 7,840 Sales 7,840 B) Accounts receivable 8,000

Source Image: tandfonline.com

Download Image

FoodBlogs: The Magazine by gratefulink – Issuu Study with Quizlet and memorize flashcards containing terms like Cash may not include:, Compensating balances represent:, On November 10 of the current year, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. Flores uses the gross method of accounting for sales discounts.What is the correct entry for Flores on November 10? and more.

Source Image: issuu.com

Download Image

PPT – Southeast Asia PowerPoint Presentation, free download – ID:1550957 May 25, 2023On November 10, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. The way Flores would record the sale on November 10th is by debiting Accounts Receivable for $8,000 and crediting Sales Revenue for $8,000.. The customer has 30 days to pay for the carpet but may deduct a 2% discount from the amount owed if paid within 10 days (2/10).

Source Image: slideserve.com

Download Image

Mayra Flores | The Texas Tribune How would Flores record the sale on November 10 B. Accounts Receivable 8,000 Sales Revenue 8,000 On November 10 of the current year, Flores Mills provides services to a customer for $8,000 with credit terms 2/10, n/30.

/https://static.texastribune.org/media/files/14d713bdc6521a95a8d60ff6ed119f3f/Mayra%20Flores%20Brownsville%20Rally%20MG%20TT%2021.jpg)

Source Image: texastribune.org

Download Image

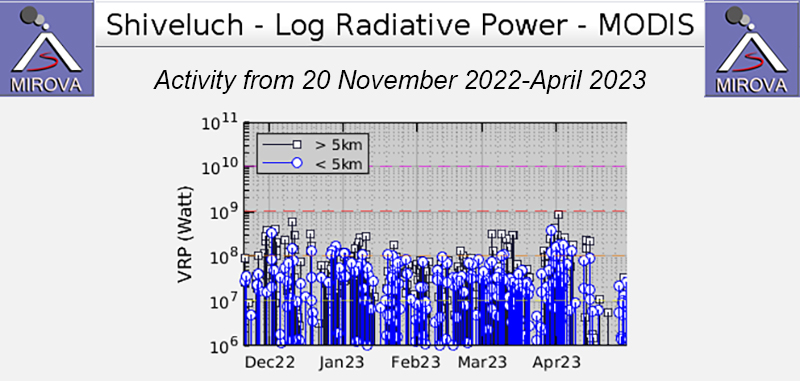

Global Volcanism Program | Bulletin of the Global Volcanism Network Jul 4, 2023sarthakcontexto123 report flag outlined The correct entry for Flores Mills on November 17, assuming the correct payment was received on that date, would be as follows: 1. First, let’s understand the credit terms mentioned in the question: – “410/” means that the customer can avail a 4% discount if they pay within 10 days.

Source Image: volcano.si.edu

Download Image

The BACKPACKERS | Mandaluyong A) $9,450. B) $12,450. C) $7,450. D) $19,650., On November 10 of the current year, Flores Mills sold carpet to a customer for $8,000 with credit terms 2/10, n/30. Flores uses the gross method of accounting for sales discounts. What is the correct entry for Flores on November 17, assuming the correct payment was received on that date?, Calistoga

Source Image: facebook.com

Download Image

Full article: Additive manufacturing and characterization of mathematically designed bone scaffolds based on triply periodic minimal surface lattices

The BACKPACKERS | Mandaluyong On November 10 of the current year, Flores Mills provides services to a customer for $8,000 with credit terms 2/10, n/30. The customer made the correct payment on December 5. How would Flores record the collection of cash on December 5? … $5,000 in property taxes include $4,000 in back taxes paid by Real Angus on behalf of the seller and

PPT – Southeast Asia PowerPoint Presentation, free download – ID:1550957 Global Volcanism Program | Bulletin of the Global Volcanism Network How would Flores record the sale on November 10 B. Accounts Receivable 8,000 Sales Revenue 8,000 On November 10 of the current year, Flores Mills provides services to a customer for $8,000 with credit terms 2/10, n/30.