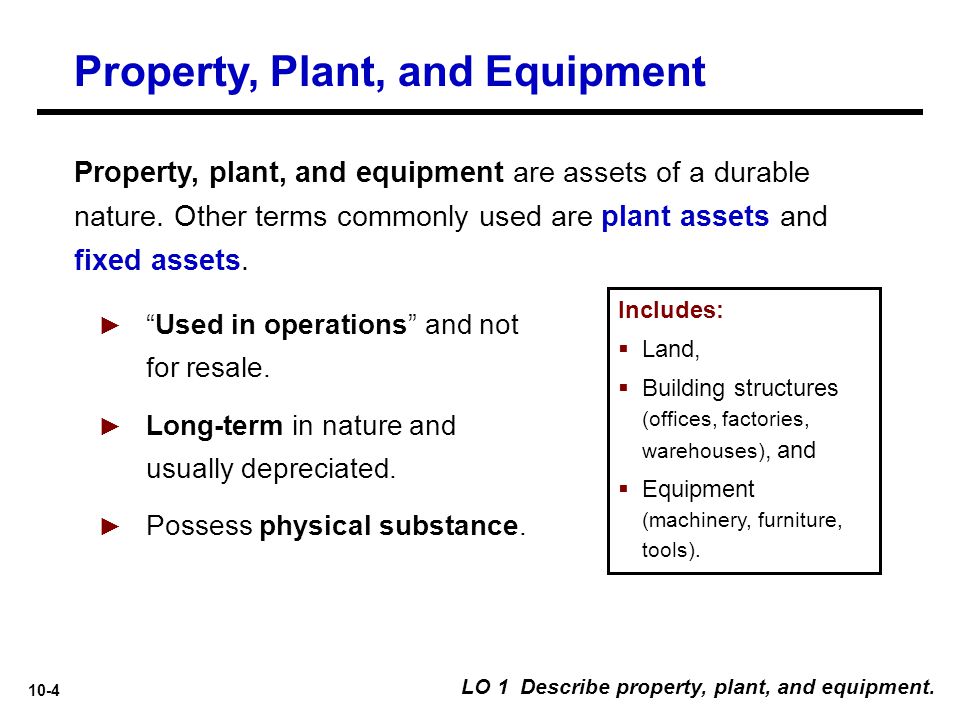

ASC 360, Property, Plant, and Equipment is the authoritative US GAAP for PP&E and defines property, plant, and equipment as follows: Excerpt from ASC 360-10-05-3 Property, plant, and equipment typically consist of long-lived tangible assets used to create and distribute an entity’s products and services and include: a. Land and land improvements b.

Accounting – Property Plant & Equipment Theory (including Depreciation) – YouTube

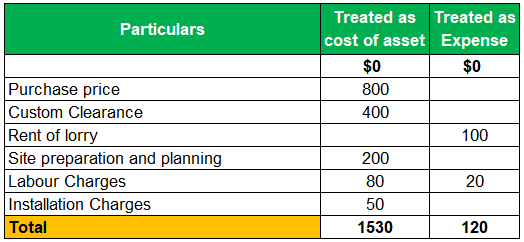

The cost of an item of property, plant and equipment is recognised as an asset if, and only if: it is probable that future economic benefits associated with the item will flow to the entity; and; the cost of the item can be measured reliably. An item of property, plant and equipment is initially measured at its cost. Cost includes:

Source Image: shopify.com

Download Image

Property, plant and equipment is the long-term asset or noncurrent asset section of the balance sheet that reports the tangible, long-lived assets that are used in the company’s operations. These assets are commonly referred to as the company’s fixed assets or plant assets. Generally, the property, plant and equipment assets are reported at

Source Image: accounting-services.net

Download Image

The Eight Themes That Will Shape the Data Center Industry in 2024 | Data Center Frontier Property, Plant and Equipment In April 2001 the International Accounting Standards Board (Board) adopted IAS 16 Property, Plant and Equipment, which had originally been issued by the International Accounting Standards Committee in December 1993.

Source Image: shopify.com

Download Image

Property Plant And Equipment Is Considered Which Type Of Asset

Property, Plant and Equipment In April 2001 the International Accounting Standards Board (Board) adopted IAS 16 Property, Plant and Equipment, which had originally been issued by the International Accounting Standards Committee in December 1993. Oct 22, 2023Property, plant, and equipment (PP&E) includes tangible items that are expected to be used in more than one reporting period and that are used in production, for rental, or for administration. This can include items acquired for safety or environmental reasons. In certain asset-intensive industries, PP&E is the largest class of assets.

What Is an Asset? How to Classify Assets for a Balance Sheet (2024)

Property, Plant, and Equipment (PP&E) is a non-current, tangible capital asset shown on the balance sheet of a business and is used to generate revenues and profits. PP&E plays a key part in the financial planning and analysis of a company’s operations and future expenditures, especially with regards to capital expenditures. 10 Acquisition and Disposition of Property, Plant, and Equipment – ppt download

Source Image: slideplayer.com

Download Image

Acquisition and Disposition of Property, Plant, and Equipment | PPT Property, Plant, and Equipment (PP&E) is a non-current, tangible capital asset shown on the balance sheet of a business and is used to generate revenues and profits. PP&E plays a key part in the financial planning and analysis of a company’s operations and future expenditures, especially with regards to capital expenditures.

Source Image: slideshare.net

Download Image

Accounting – Property Plant & Equipment Theory (including Depreciation) – YouTube ASC 360, Property, Plant, and Equipment is the authoritative US GAAP for PP&E and defines property, plant, and equipment as follows: Excerpt from ASC 360-10-05-3 Property, plant, and equipment typically consist of long-lived tangible assets used to create and distribute an entity’s products and services and include: a. Land and land improvements b.

Source Image: youtube.com

Download Image

The Eight Themes That Will Shape the Data Center Industry in 2024 | Data Center Frontier Property, plant and equipment is the long-term asset or noncurrent asset section of the balance sheet that reports the tangible, long-lived assets that are used in the company’s operations. These assets are commonly referred to as the company’s fixed assets or plant assets. Generally, the property, plant and equipment assets are reported at

Source Image: datacenterfrontier.com

Download Image

Property Plant and Equipment – Meaning, Formula, Examples Property, Plant, and Equipment is considered why type of asset? A. current assets B. contra assets C. tangible assets D. intangible assets Solution Verified Answered 1 year ago Create a free account to view solutions By signing up, you accept Quizlet’s Terms of Service and Privacy Policy Continue with Google Recommended textbook solutions

Source Image: wallstreetmojo.com

Download Image

Intermediate Accounting – ppt download Property, Plant and Equipment In April 2001 the International Accounting Standards Board (Board) adopted IAS 16 Property, Plant and Equipment, which had originally been issued by the International Accounting Standards Committee in December 1993.

Source Image: slideplayer.com

Download Image

PP&E (Property, Plant & Equipment) – Overview, Formula, Examples Oct 22, 2023Property, plant, and equipment (PP&E) includes tangible items that are expected to be used in more than one reporting period and that are used in production, for rental, or for administration. This can include items acquired for safety or environmental reasons. In certain asset-intensive industries, PP&E is the largest class of assets.

Source Image: corporatefinanceinstitute.com

Download Image

Acquisition and Disposition of Property, Plant, and Equipment | PPT

PP&E (Property, Plant & Equipment) – Overview, Formula, Examples The cost of an item of property, plant and equipment is recognised as an asset if, and only if: it is probable that future economic benefits associated with the item will flow to the entity; and; the cost of the item can be measured reliably. An item of property, plant and equipment is initially measured at its cost. Cost includes:

The Eight Themes That Will Shape the Data Center Industry in 2024 | Data Center Frontier Intermediate Accounting – ppt download Property, Plant, and Equipment is considered why type of asset? A. current assets B. contra assets C. tangible assets D. intangible assets Solution Verified Answered 1 year ago Create a free account to view solutions By signing up, you accept Quizlet’s Terms of Service and Privacy Policy Continue with Google Recommended textbook solutions