Finance questions and answers. Mendez Company has identified an investment project with the following cash flows.a. If the discount rate is 7 percent, what is the present value of these cash flows? (Donot round Intermedlate calculatlons and round your answer to 2 declmal places,e.g., 32.16.)b. What is the present value at 16 percent?

It is time to make the African Dream a reality’ – Mario Mendes | Africa Renewal

Mendez Company has identified an investment project with the following cash flows. … Christie, Incorporated, has identified an investment project with the following cash flows Year 1 CF $1,030 Year 2 CF $1,260 Year 3 CF $1,480 Year 4 CF $2,220 a. If the discount rate is 8 percent, what is the future value of these cash flows in Year 4?

Source Image: laskasas.com

Download Image

Mendez Company has identified an investment project with the following cash flows. What is the present value at 18 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Solution Verified Answered 4 months ago Create a free account to view solutions Continue with Google

Source Image: frameweb.com

Download Image

Gardening Diversity In Our Lives And Our Communities Mendez Company has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations; round your answer to 2 decimal places, e.g., 32.16.) Solution Verified Answered 4 months ago Create a free account to view solutions

Source Image: coolhunting.com

Download Image

Mendez Co Has Identified An Investment Project

Mendez Company has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations; round your answer to 2 decimal places, e.g., 32.16.) Solution Verified Answered 4 months ago Create a free account to view solutions Mendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 2 3 4 $780 1,050 1,310 1,425 a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b.

Inside New Canaan, Connecticut’s Enveloping “At The Noyes House” Exhibition – COOL HUNTING®

Finance questions and answers. Problem 4-11 Present Value and Multiple Cash FlowsMendez Company has identified an investment project with the following cash flows.a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do notround intermediate calculations and round your answer to 2 decimal places, e.g.,32 … Human Rights – WCW’s Women Change Worlds Blog – Wellesley Centers for Women

Source Image: wcwonline.org

Download Image

Top 100 Executives 2021 – Adena Friedman (CEO) Nasdaq – Leaders League Finance questions and answers. Problem 4-11 Present Value and Multiple Cash FlowsMendez Company has identified an investment project with the following cash flows.a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do notround intermediate calculations and round your answer to 2 decimal places, e.g.,32 …

Source Image: leadersleague.com

Download Image

It is time to make the African Dream a reality’ – Mario Mendes | Africa Renewal Finance questions and answers. Mendez Company has identified an investment project with the following cash flows.a. If the discount rate is 7 percent, what is the present value of these cash flows? (Donot round Intermedlate calculatlons and round your answer to 2 declmal places,e.g., 32.16.)b. What is the present value at 16 percent?

Source Image: un.org

Download Image

Gardening Diversity In Our Lives And Our Communities Mendez Company has identified an investment project with the following cash flows. What is the present value at 18 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Solution Verified Answered 4 months ago Create a free account to view solutions Continue with Google

Source Image: permaculturewomen.com

Download Image

Fashion Deck Projects :: Photos, videos, logos, illustrations and branding :: Behance Worksheet ecture 4 – DCF Valuation Mendez Co. has identified an investment project with. Principles of Management (MNG 3103) Students shared 34 documents in this course. Christie, Inc., has identified an investm. An investment offers $3,850 per year for 15 years, wi. hat would the value be if the paym. If you put up $45,000 today in e

Source Image: behance.net

Download Image

Incorporate the quiet luxury trend into your home – Vibrant Doors Blog Mendez Company has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations; round your answer to 2 decimal places, e.g., 32.16.) Solution Verified Answered 4 months ago Create a free account to view solutions

Source Image: vibrantdoors.co.uk

Download Image

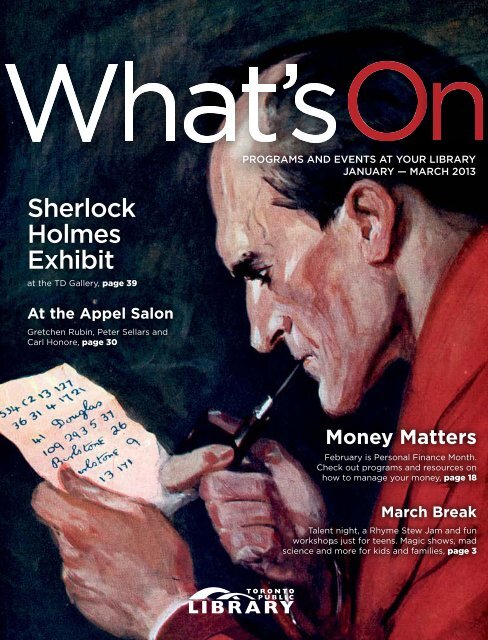

March 2013 (PDF) – Toronto Public Library Mendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 2 3 4 $780 1,050 1,310 1,425 a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b.

Source Image: yumpu.com

Download Image

Top 100 Executives 2021 – Adena Friedman (CEO) Nasdaq – Leaders League

March 2013 (PDF) – Toronto Public Library Mendez Company has identified an investment project with the following cash flows. … Christie, Incorporated, has identified an investment project with the following cash flows Year 1 CF $1,030 Year 2 CF $1,260 Year 3 CF $1,480 Year 4 CF $2,220 a. If the discount rate is 8 percent, what is the future value of these cash flows in Year 4?

Gardening Diversity In Our Lives And Our Communities Incorporate the quiet luxury trend into your home – Vibrant Doors Blog Worksheet ecture 4 – DCF Valuation Mendez Co. has identified an investment project with. Principles of Management (MNG 3103) Students shared 34 documents in this course. Christie, Inc., has identified an investm. An investment offers $3,850 per year for 15 years, wi. hat would the value be if the paym. If you put up $45,000 today in e